Financial emergencies are certain. Every individual once in their lifetime comes across financial crisis that can put them in a situation of taking a loan. Fortunately, everyone can get loans through lenders and banks. However, it is not easy to acquire one as it sounds.

A credit card is one of the ways in which you can borrow money. However, it is an unsecured loan for which the lender gives credit under a condition that you will repay it. It is a form of non-physical money. However, when it comes to getting a liquid case, you will be required to attach the loan with some form of collateral. Car title loans are effective in this context.

img source: zroomcarloans.com.au

Collateral is something which works as a guarantee for a loan against a vehicle. A secured interest is created in the property. If the borrower fails to repay, then the lender may raise his right to repossess the collateral. However, there is a specific legal process that must be followed. For a wide range of people, car title loans have become a norm. You can easily get vehicle title loan online through directories like https://fasttitleloansnearme.com/car-title-loans.

Understanding the loan on your vehicle title

Even though it sounds clear and simple, there are some technicalities associated with it. These loans are usually given by financial lenders charging a decent amount of interest. Many companies can charge a tremendous amount of interest on these loans. It is imperative to familiarize yourself with the benefits as well as the risks associated with such loans.

img source: pscunow.com

These loans are normally targeted to those who have low incomes. Normally everyone owns a car or any form of vehicle. It can easily be used as collateral if you want a loan in an emergency. Since it has a lower processing time period, you can easily get it in no time.

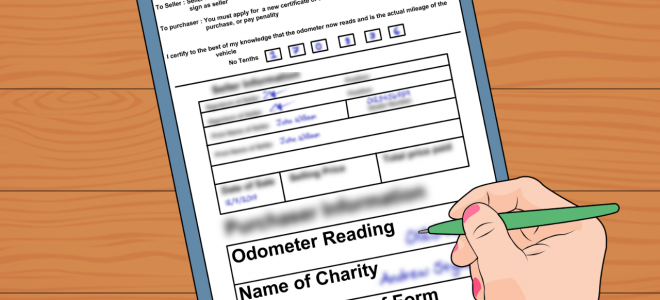

Handing the vehicle title over

After the title loan lender is selected and the insurance processes have been complied with, there is a need to hand over the signed title. This means that until the loan is repaid, the legal right will lie within the lender. In other words, the borrower will not be able to sell the car to anyone. Even though he may be able to use it, the legal right is with the lender.

By the terms of the loan, monthly payments will be made. Typically, most borrowers tend to pay the loan back within six months or in a year. As soon as the entire amount is repaid, you will get your title back.

The bottom line

Car title loans or loans in which car is used as collateral is one of the easiest ways in which you can get your hands on an instant cash. The benefits are immense. However, it is important to keep in mind that there are some drawbacks as well. Car title loans have higher interest rates compared to other types of loans. You need to be aware of the terms and rates of interest in detail before signing any agreement.